Published on March 14th, 2025

By Kwame Donaldson

Across the nation, more apartment units were completed last year than in any year since 1974. While this swell in supply was matched with an increase in demand in many markets, it also led to slow rent growth in areas where homebuilding was already robust. In this market update, we show where the construction surge had the greatest impact and predict if it is likely to persist into this year. These insights can help you navigate challenges and unlock new opportunities, turning market changes into a competitive edge.

Austin and Hartford: A Tale of Two Cities

The local economies in Austin, Texas, and Hartford, Connecticut, have a lot in common. Both cities are state capitals, which means that each metro area’s labor market features an outsized share of public sector employees and legal professionals.

Additionally, each city features a large corporate workforce dominated by a single industry. Austin, also known as Silicon Hills, is home to technology giants such as Dell, Oracle, and Tesla; Hartford, the historical hub of America’s insurance business, claims industry leaders Aetna and The Hartford.

While both metro areas have large, well-educated populations, each is also within driving distance of two of the 10 largest urbanized areas in the United States, giving businesses and residents convenient access to the complete spectrum of major metropolis markets and amenities.

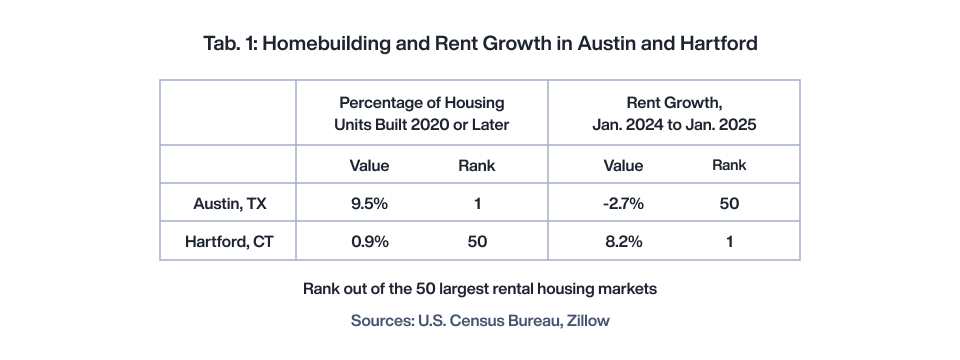

Despite these similarities, Table 1 highlights two ways that Austin and Hartford could not be more different. According to the Census Bureau’s latest American Community Survey, nearly 10% of Austin’s housing units were built in this decade, which is the highest share among the 50 largest rental housing markets in the United States. On the other hand, less than 1% of housing units in Hartford were built in 2020 or later, the group’s smallest share. Homebuilding in this dataset includes rental and owner-occupied units.

The difference in rent growth between these two cities is just as dramatic. According to data compiled by Zillow, the typical observed rent in Austin is nearly 3% lower than it was one year ago, the slowest growth rate among major rental markets in the United States. On the other hand, rents in Hartford increased by more than 8% over the last year, the fastest growth rate in the group of 50 metro areas.

Widespread Inverse Relationship Between Homebuilding and Rent Growth

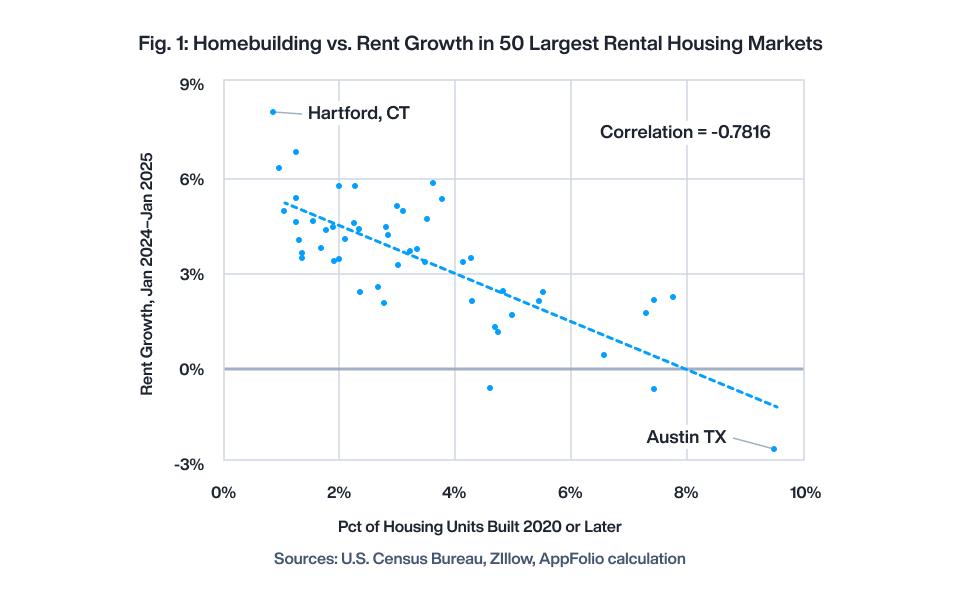

Table 1 suggests an inverse relationship between homebuilding and rent growth. Apartment owners in Austin, where construction has surged, are seeing rents slump, while rents are spiking in Hartford where construction has stalled. Figure 1 confirms that this tendency is not limited to these two cities.

Each dot in Figure 1 represents a metro area that ranks among the nation’s top 50 rental markets. The horizontal axis measures the percentage of housing units in the metro area that were built in 2020 or later. The vertical axis measures rent growth in the metro area between January 2024 and January 2025.

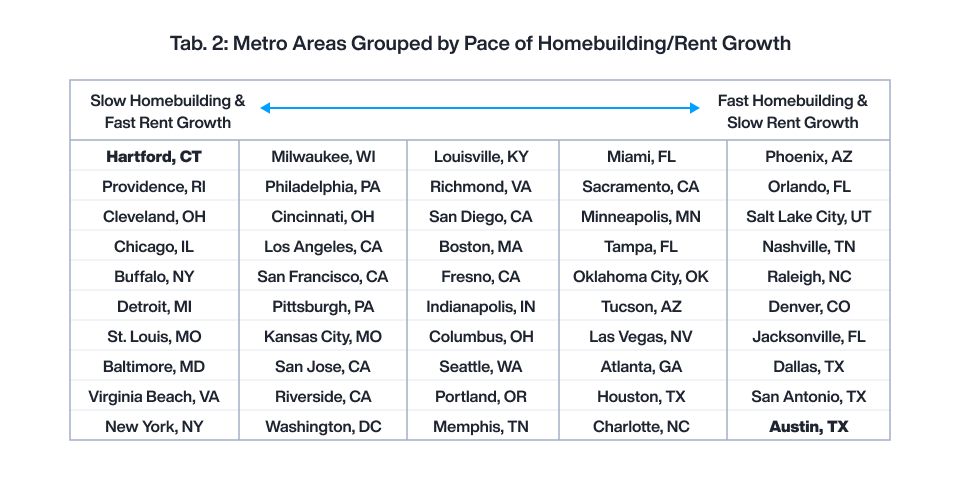

The points in Figure 1 reveal a clear, inverse relationship between homebuilding and rent growth. Like Austin, several other cities with high rates of residential construction are seeing slow rent growth. The last column of Table 2 lists these cities. Meanwhile, in Hartford and the other cities in the first column, homebuilding has been tepid, and rents are surging.

The correlation between these two variables is -0.78, which is robust. For comparison, AppFolio calculated the correlations between rent growth over the last 12 months and 487 social, economic, housing, and demographic characteristics measured in the American Community Survey; the relationship between rent growth and homebuilding illustrated in Figure 1 is the strongest of them all.

This negative correlation is not a surprise. Textbook economic theory argues that prices will fall in response to an increase in supply. Homebuilding adds inventory and new suppliers to the housing market; all other things being equal, economists expect existing apartment managers in construction-heavy cities such as Austin to lower rents in response to the increased competition for residents. Meanwhile, Hartford’s incumbent landlords, who face very little pressure from new suppliers, are not constrained by this market dynamic.

But the expected inverse relationship between homebuilding and rent growth depends on the qualifier: all other things being equal. In a dynamic housing market, many other factors simultaneously influence homebuilding and rent growth. While the unsurprising negative correlation is evident in the latest data (Figure 1), interdependencies with other factors usually make the connection between these variables harder to discern.

Homebuilding Outpaces Demand in the Fastest-Growing Cities

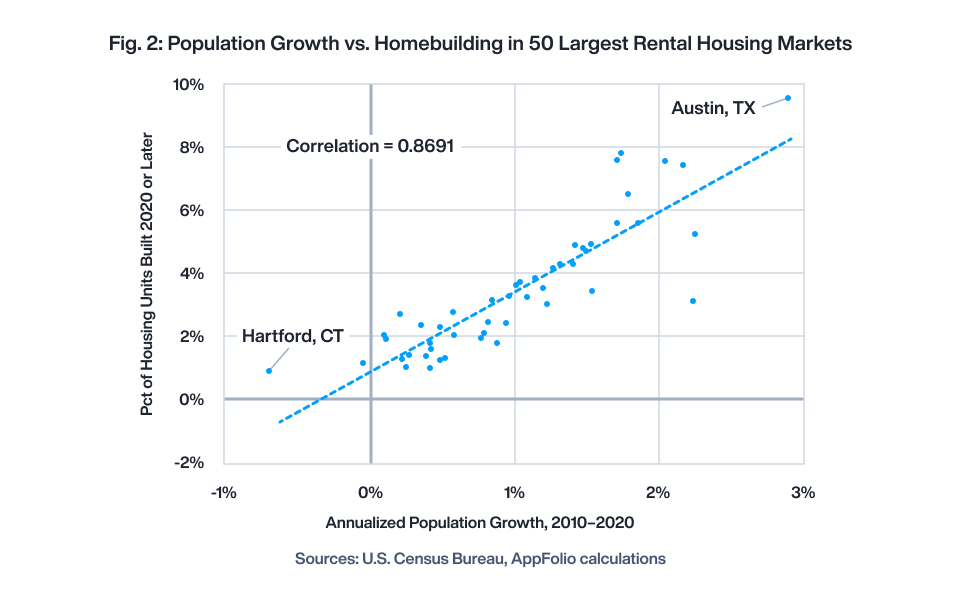

Population growth is one of the interdependent variables that affects construction and rent. In particular, a growing population boosts apartment demand, which should result in faster rent growth. The increase in rents will encourage residential construction as developers sprint to supply new units to the more lucrative housing market. In other words, the correlation between population growth and construction activity should be positive.

Figure 2 confirms this expectation. Previously, we learned that among major rental markets, Hartford is experiencing the nation’s slowest rate of homebuilding; in Figure 2, we find that this metro area also had the group’s slowest rate of population growth between 2010 and 2020. By contrast, Austin claimed last decade’s fastest pace of population growth, and it boasts the highest rate of recent homebuilding. The positive correlation extends beyond these bookends. Expanding the analysis to the 50 largest markets, we see that the nationwide correlation between population growth and homebuilding is very robust at 0.87.

The trendline in Figure 2 is an estimate of the rate of homebuilding that we should expect in any large metro area based only on population growth between 2010 and 2020. We see that Austin and many other fast-growing cities lie above the trendline, indicating that homebuilding in these cities has surged past demand. This surplus housing supply is partially responsible for the cooldown in rent growth that we are observing in the fastest-growing cohort.

Though this cooldown is an unwelcome outcome for apartment owners and property managers, “surplus supply” is only a short-term assessment. If population growth continues on its current trajectory, housing demand in fast-growing cities will eventually catch up to the surge in new units. Landlords in Austin, who are coping with slow rent growth today, are well-positioned to benefit from the area’s healthy population growth in the future.

Multifamily Construction to Recede

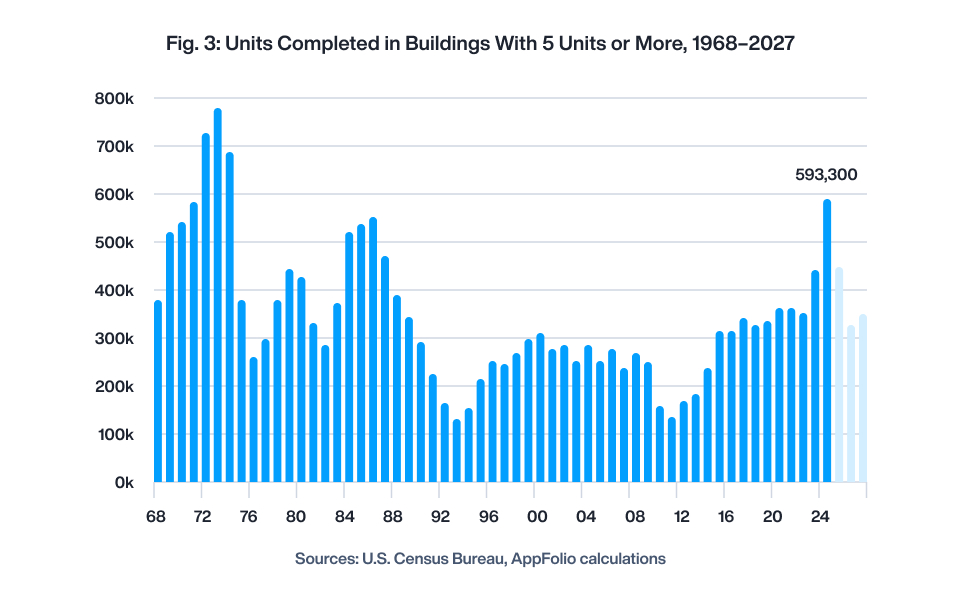

However, surplus supply will not fall in line with population growth if apartment construction does not retreat from its near-record pace. According to the Census Bureau, nearly 600,000 multifamily units were completed in 2024, the most in 50 years (Figure 3).

Most of the units that were completed last year broke ground in 2022, just as the Fed started hiking interest rates. Multifamily developers who were aware of these Fed actions advanced construction on many apartment projects to take advantage of expiring low interest rates. Last year’s spike in completions is the result of those two-year-old investment decisions.

Figure 3 also includes AppFolio’s forecast of the number of multifamily units that will be completed between 2025 and 2027. This projection is derived from the number of units that are currently under construction, when those developments broke ground, and the number of months it typically takes for most multifamily projects to be completed. According to this forecast, the number of units that will be delivered in 2025 and 2026 will retreat from the 50-year high reached last year. This slowdown should encourage faster rent growth in cities such as Austin and across the nation over the next two years.

Opportunities for Property Managers

In cities such as Austin, where a surge in construction has led to slower rent growth and rising vacancies, property managers must adapt by enhancing efficiency, attracting renters, and controlling costs. The solutions that AppFolio offers provide a competitive advantage in this challenging environment.

- FolioSpace can help boost renewals by improving resident satisfaction and opening up new revenue opportunities to alleviate declining rental income.

- Flex Rent, Security Deposit Alternatives, and other financial services for renters are in high demand but not widely available, so they offer a way for our customers to stand out from their competition.

- Realm-X Flows improves efficiency by automating key processes, from lead nurturing to lease renewals and delinquency management. Additionally, Realm-X Assistant and Messages streamline communication, enabling staff to respond quickly and effectively while maintaining high resident satisfaction.

While Austin’s current rental market faces short-term headwinds due to surging supply, property managers who leverage the right technology can navigate these challenges successfully, positioning themselves for long-term growth as supply and demand rebalance in the years ahead.

In metro areas such as Hartford, where less construction has helped drive faster rent growth and keep vacancies low, property managers must focus on optimizing pricing, automating workflows, and maintaining efficiency to sustain profitability. The solutions that AppFolio provides can also help streamline operations and maximize performance in this high-growth environment.

- Leasing Signals allows you to make thoughtful pricing decisions using your unique pricing strategy and explainable pricing suggestions based on public data.

- AI Leasing Assistant, Lisa allows leasing teams to manage high inquiry volumes, and Realm-X Flows automates lead nurturing without added strain or headcount.

- Mobile and Smart Maintenance enable quick service request resolutions when occupancies are high and maintenance needs grow, ensuring resident satisfaction and reducing turnover risk.

- FolioSpace further enhances operational efficiency with Resident Onboarding, which automates the move-in process, and the move-in/out dashboard provides full visibility into resident transitions.

As healthy rent growth encourages more multifamily construction in cities such as Hartford, property managers who leverage these advanced tools can maintain efficiency, optimize revenue, and capitalize on market momentum while delivering exceptional service to residents and owners alike. To learn more about how you can stay ahead of the curve, download our 2025 Property Management Benchmark Report.

Comments by Kwame Donaldson